Best Places To Trade Bitcoin or Cryptocurrency

There are a couple of places which offer Bitcoin trading, have been around a long time, established in the market place and have good TrustPilot reports.

Now for those who want to get into trading for free, there is an option for you, it’s Stormgain, they have a faucet which they call cloud mining, once you’ve mined $10 you can withdraw to your trading account, thus you begin trading for free. The miner runs for 4 hours at which point you click 1 button to restart for another 4 hours. You can also access your account on your phone via their app.

Now for those who are looking to Invest, a more serious option is Binance and BitMex, they allow you to trade on leverage, so best for those who understand how to trade and invest.

Now there are other trading platforms, they may well be good, however I haven’t used them, those above are ones I trust. So, if you decide to try somewhere different, do your research and don’t fall for the many scam sites out there.

Strategies To Invest

Investing in cryptocurrencies comes with rewards but not without its risks as well.

Therefore, you wish to take a position strategically to maximize your return on investment and minimize your risks. There are specific strategies you would like to adopt to make sure a successful cryptocurrency investment and building your portfolio.

There are 5 strategies, which are available and handy for you especially if you’re relatively new to the cryptocurrency realm.

- Understand the entire concept of cryptocurrency

- Spy on the market

- Invest in additional than one coin

- Start small and scale higher

- Reallocate your investment

Firstly, you need to know the full concept of cryptocurrency.

With investing it’s never a good idea to invest in something you don’t understand, otherwise you’ll never understand what causes the price to move. Ignore the many messages about getting in on the next Bitcoin, they play on your fear of missing out.

For example, plenty of individuals see their peers investing in property and that they just imitate in hopes to come up with millions without even conducting prior research.

Therefore, the primary thing you must do is, research the world of cryptocurrency. These are the small print to be digested before kick-starting your investment:

- What is cryptocurrency?

- What is Blockchain Technology?

- What is Bitcoin?

- What are the opposite popular digital currencies?

- What are the coin’s market caps?

- How are you able to start your cryptocurrency exchanges?

- Where are you able to make cryptocurrency exchanges?

Take some time to grasp the realm of cryptocurrency and don’t rush the method. It’s going to take weeks or perhaps months to digest all the knowledge but this step is imperative for you so you’ll be able to get on top of the sport and an expert within the field.

This way, there’s an awfully low chance for you to waste your resources as you’re conversant in the cryptocurrency industry.

The second strategy to speculate is to spy on the market.

What does spying on the market mean? Spying on the market means you’re observing what’s currently working within the cryptocurrency market. What you would like to specifically examine is:

- What is that the most asked for currency?

- What is that the value of the currency?

- Which currency has the best market cap?

- Should you purchase and hold the currency for future investments?

Always remember that the cryptocurrency market is extremely volatile and also the values fluctuate every now so.

The values usually depend upon lots of things like the speculators, the market demand, the availability demand, and different institutions manipulating the costs.

General advice would be to explore all your options, window shop, don’t impulse buy flashy marketed, it could be a case of the emperor’s new clothes.

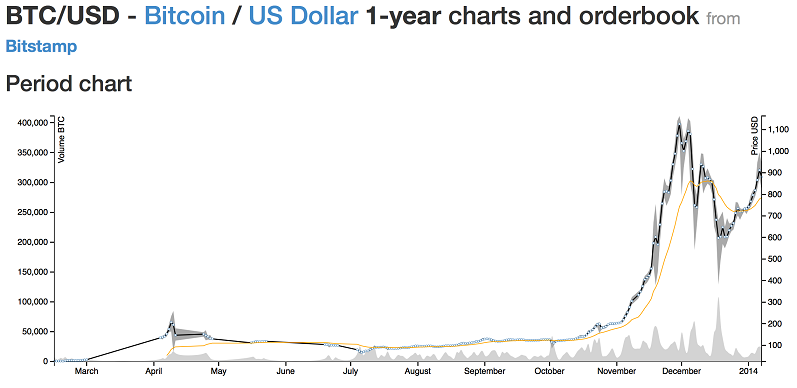

For instance, the foremost asked for currency at the instant is Bitcoin, but many professional traders and investors have predicted that Ethereum may surpass Bitcoin and become the currency of the longer term within the coming years. Therefore, always spy on the market and analyze the data.

The next strategy is to take an additional position in more than one cryptocurrency. It’s not clever to invest all of your money into one digital currency. A well-balanced portfolio minimizes your risk as after you possibly lose on a cryptocurrency you own, you’ll still gain with the alternative ones you’ve got.

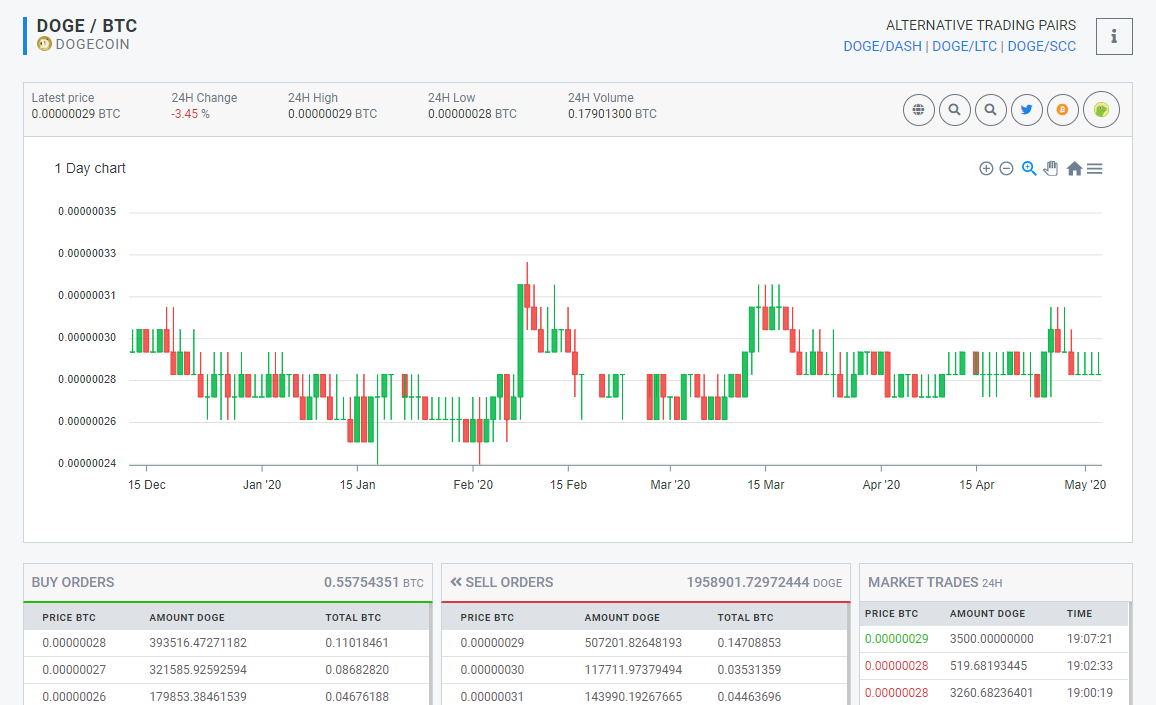

If you choose to take a position in precisely one currency for instance Dogecoin, what if the entire currency collapses? You’ll lose all of the cash you’ve got invested in an instant with no backups.

Therefore, always invest in 2 or more currencies. Constantly spy on the market and choose the currency you like.

The fourth strategy is to begin small and scale higher as you go.

A lot of individuals assume you become instantly rich after you invest in cryptocurrency. However, that’s not always the case. You don’t just become rich once you decide to speculate in cryptocurrency. There are a technique and a learning curve to urge where you would like to be.

Therefore always remember to begin small, especially for those that have a tiny low-risk appetite. As mentioned within the previous articles, cryptocurrency values are very volatile because it depends on many factors. The values fluctuate even more during this cryptocurrency season where many of us are commencing to trade digital currencies.

For beginners, the rule of thumb is to begin investing say $500 for your cryptocurrencies. You don’t necessarily need to start investing thousands! Now that you just have your $500, how does one divide the cash, and what currency does one start to get first?

Firstly, remember to sign on for your digital wallet, and deposit your fiat currency and get the highest 2 cryptocurrencies; Bitcoin and Ethereum.

The reason why we’re selecting the two is that they’re the safest and established choice as compared to the opposite currencies. They’re vulnerable to fluctuation, but not the maximum amount for now.

So, you split the $500, and buy $250 worth of Bitcoin and $250 for Ethereum. this is often a wise option and if there are chances of you losing any of your funds, the danger remains worth taking.

When you get the hang of it, you’ll be able to scale your investment higher by purchasing your cryptocurrencies at an exceedingly higher value.

Last but not least is to reallocate your investment.

Once you’ve completed all the steps from 1-4, which implies you’re accustomed to the cryptocurrency realm, you’ll reallocate your funds in step with the digital currency market.

When you’ve started trading and investing, you’ll notice over a period of your time some currencies will do better than others.

For instance, you’ve observed Bitcoin’s market and it’s gone up whereas Ethereum has gone down, you’ll be able to drag your funds to the upper currency market. This means you’ll fiddle in step with what’s working within the current market and constantly reallocate your money.

When you get the hang of it, you’ll realize that your investment will build up eventually from $500 to $1000, from $1000 to possibly $100,000! Always remember to try and do your part in aiming to know more of the cryptocurrency market as there’s always something new to scrutinize. Be strategic in your investment and only investment in what you know!

Tips On Trading, Investing And Reading Signals

Now many people think trading and investing are one and the same, however, they are not. Investing is more of a Medium to Long term view and Trading is more of a Short-term view.

Within trading and investing there are two main ways to evaluate any asset, these are Fundamental and Technical. So far as Crypto is concerned there is not much in the way of fundamentals to base decision on like there is in the stock market, so you’ll have to rely on either Luck or Technical Analysis.

The good news is that Stormgain, BitMex and Binance all offer some kind of charting to be able to apply trading signals.

Common signals that traders are using are;

- MACD/OsMA (9,12,26)

- Moving Average (50, simple)

- Moving Average (100, simple)

Rather than try to explain in writing, I’ll include some video’s to watch that will explain each of these. When you get experience you can then adapt these to your given time frames you’re using.

MACD/OsMA

Moving Average

Why Invest In Cryptocurrency: Adopting the correct Mindset

Before we start talking about why you would like to take a position in cryptocurrency, you may first and foremost have to adopt the correct mindset in situ. What does having the correct mindset mean?

Having the correct mindset means being open-minded, thinking positive and not whining or complaining after making a choice, and being in charge of the alternatives you’ve got made.

Complaining and whining won’t get you anywhere. The market doesn’t care about your complaints, because the market will always be the market. Over the last number of months, cryptocurrency became a world phenomenon to several and has taken the planet unexpectedly.

While not everyone understands the cryptocurrency realm and the way precisely the system operates, banks, governments, and firms are cognizant of its importance because the cryptocurrency market cap is extremely volatile where the worth of a crypto coin may reach thousands of dollars.

Therefore, it might be such a waste if you decide to ignore what’s currently happening within the market when there are countless opportunities for you to pursue.

To have the proper mindset to start with, firstly you have got to be excited to start! If you recognize how vibrant the globe of cryptocurrency is, you’d want to begin instantly.

How are you able to start investing in something you have got completely no interest in? after you venture into an investment without the sensation of pleasure or eagerness, it’ll reflect on the cash you’ve earned. you may only feel a scarcity of fulfillment and worse still, it’s as if you’re being forced to try to do something you are doing not like.

There are two important principles so as for you to own an investor’s mindset:

(I) specialize in opportunities, not problems

(II) Take action and keep on with it, don’t succumb to fear

Let’s target the primary principle, which is opportunities vs. problems.

Many investors can come up with 100 problems but can’t even think about a single opportunity. as an example, “It’s impossible to grasp the full cryptocurrency system” and “the cryptocurrency values are very volatile and that I might lose all my money,” or just “I don’t have time to invest“.

We know where this is often heading. sometimes there are indeed such a lot of obstacles that it becomes difficult for us to spot opportunities. However, don’t let your challenges discourage you from exploring the rich market of cryptocurrency.

If you knew of the countless opportunities available, you’d never complain and be pessimistic of the drawbacks as you’d probably overcome them.

The second principle is to require action!

A great mindset would be meaningless without action. Fear won’t get you far, and fear will always be your limiting consider taking that leap of religion. you’ve got to begin now. So remember to be firm in your choices, believe what you pursue, and make a difference in your life!

What Is Investment?

The word investment simply means the action of investing money for future gains. Your future gains will be within the type of assets or stocks and also a cryptocurrency, which you buy intending to get passive income. Your asset’s value may appreciate in the future. Once you’ve made a conscious option to invest, you’re now not working for money. you’re making money work for you.

For those that favor not invest or don’t possess the notice to try and do so, their monthly cycle would probably go like this. you’re a full-time employee working the hours to finish the task given to you by your superiors. Sometimes, you’d also have to work extra hours to atone for the additional workload.

By the top of the month, you’re then given a considerable amount of pay as a variety of rewards. Nothing wrong therewith, but does one need to measure a mediocre life and just making ‘enough’ to measure by for the remainder of your life?

That is why you’d have to devise a replacement arrangement to lead the life that you just desire, to make not only financial stability but also sustainability. rather than creating duplicates of yourself, which you can’t, you’ll have to find some way so your money can work for you.

Even if you continue to prefer to keep your 9-5 job, your money from your investment is functioning for you further. you may be rewarded by having more money in your account. this is often one in every of the best thanks to maximizing your potential to earn more and you don’t even have to receive any raise working overtime or perhaps hop from one job to a different for it. within the end, investment is that the key considers putting your money to figure, without you having to compromise your hours!

Why must you Invest?

Have clarity on why you’re investing.

You don’t just decide why you would like to speculate. Well, you wish for extra money. Everyone does. But what defines your investment? Why does one even invest? you’ve got to be further from this, so you know where you’re heading, and devise a strategic commitment to getting there.

Some people would want to invest to avoid wasting for his or her retirement. Those days when everyone worked similar jobs for 40 years and retired to a pleasant pension are gone. These days, it’s quite that. With the value of living increasing day by day, you need to comprehend that being solely passionate about your pension would realistically not be sufficient to sustain your future.

You should be investing to avoid wasting more cash for your retirement. you’ll start now by optimizing your retirement savings into a series of investments. Then, you’d surely see the results during your retirement age, by living off the funds you gain from these investments.

Many folks invest because they wish to realize a particular financial goal. therein goal, investment plays an enormous role to assist you to earn it. Either you would like to begin your own business, have your preferred lifestyle, buy an opulent car, own a bungalow even – it all starts together with your action to take a position. Hence, it’s imperative to grasp why you want to take a position.

Remember; don’t invest solely thanks to money, it’s important to own passion in doing it. So, ensure you get your intentions right and commemorate in doing it! The investment wouldn’t seem like a chore or that daunting after you know the way to own fun.

Why Cryptocurrency Investment?

The reason why cryptocurrencies are in demand immediately is that Satoshi Nakamoto successfully found how to create a decentralized digital cash system. what’s a decentralized cash system?

A decentralized system means the network is powered by its users without having any third party, central authority, or middleman controlling it. Neither the financial organization nor the govt has power over this technique.

The problem with a centralized network in a very payment system is that the so-called “double spending”. Double spending happens when one entity spends the identical amount twice. as an example, after you purchase things online, you have got to incur unnecessary and expensive transaction fees. Usually, this is often done by a central server that keeps track of your balances.

Apart from cryptocurrency being very secure and is run through a decentralized network, other properties project why cryptocurrencies could also be the foremost talked about topic in town. it’s now viewed as an emerging investment vehicle.

Have you heard of Erik Finman?

He is the teenage Bitcoin millionaire who started learning Bitcoin at only $12 a bit back in May 2011, when he was just 12 years old. He received the Bitcoin as a tip from his brother and a $,1000 gift from his grandmother.

He now reportedly owns 403 Bitcoins, which holds a worth of roughly $2,600 where it’s accumulated to a stash of $1.08 million and after.